Why use HCP social media for market research?

HCP Social media market research may be something you have already had some experience in or it might be a totally new concept to you. Either way, it is important to understand the differences between this approach and conducting primary market research.

Primary market research (PMR) gives you a response to direct questions from a targeted audience, whether HCP or public. When conducting general social media market research you will have, compared with PMR, usually a high volume of unprompted conversation from an unfiltered audience. So where does HCP social media listening fit in? HCP social media listening gives you the unprompted conversation of a targeted selection of HCPs (by country or therapy area).

HCP Social media market research can bring you insights during different stages of the product life-cycle. For example, for your strategy, you will be able to:

- Discover unmet needs from your HCP customers.

- Understand the competitive and market access environment.

- Build pre-launch advocacy for your candidate.

It can also inform your content planning by understanding the HCP channel preference, digital behaviours and key interests. And by identifying key online influencers and learning from the HCP behaviours you can develop your engagement tactics.

CREATION.co isolates the voice of the healthcare professionals (HCPs) from the rest of the public social media conversation out there. We are currently tracking nearly 3M HCP social media profiles worldwide, who have collectively posted more than 1.7Bn times

One client recently shared that tracking the unprompted conversations of HCP on social media gives them insights that they would not get from traditional primary market research. Here are some other reasons why our clients are using social media for HCP market research:

- To learn new things about customer needs.

- To identify influencers (Digital Opinion Leaders).

- For customer views on products and therapy areas.

- For competitive analysis.

- For medical congress strategy and tracking.

- To learn about perspectives among patients and the public.

- To learn about HCP digital behaviours and preferences.

Let’s look at some real examples of how HCP social media market research has helped our pharma clients and how they have applied the HCP insights.

Case studies for HCP social media market research

Entering an established market

One top-10 pharma client approached us when they were planning the launch of a new product into an established market in the US. The product was not first to market; in fact, there was another well-established product in use.

We helped the client team to understand why HCPs were disappointed with the existing product so that they could develop effective messaging emphasising their product’s benefits.

We conducted a retrospective HCP insights study to develop a picture of the current unmet need in the market, and perceptions of the existing provider’s product. The insights we developed provided a clear picture of the difference that our client’s product would make.

Throughout the launch, we tracked the emerging HCP reaction and provided rapid-response alerts so that our client knew what was on the minds of HCPs anticipating and then using the product. Thanks to CREATION’s sensitive alert monitoring, issues were detected early and recommendations made to the client team well ahead of any escalation, providing the time to develop messaging in response to customer needs.

Our client’s product was a big hit and went on to play a major role in its global financial results. We were delighted to have played a part in that success and to know that patients are being cared for more effectively.

New indication launch in rare disease

Another client contacted us to support the launch of an established product into a rare disease indication where there was no existing treatment and little awareness of the condition. They were looking to increase awareness and therefore diagnosis among specialists, identify HCPs who could educate others online and identify potential centres of excellence for diagnosis.

Our direct customer intelligence solution included tracking the HCP conversation in 6 different markets and we identified the language and topics that HCPs were discussing in relation to the condition and diagnosis.

We also identified specialists who were influential online and who had a passion to educate other HCPs and geographic clusters of specialists with an interest in diagnosis for potential centres of excellence.

Using the HCP intelligence we gathered, our client was able to implement the following tactics:

- Leverage interest in diagnosis by providing tools for sharing.

- Develop a global peer network of engaged specialists through digital and offline initiatives.

- Increase diagnosis awareness by sharing medical education materials.

- Inform strategies for congress and HCP education.

Informing pharmaceutical advisory board

A top-5 pharmaceutical company approached CREATION.co when planning for an advisory board in the immunology and inflammation therapy area. The client’s goal was to maximize the effectiveness of their advisory board by learning about healthcare professionals’ current ideas and perspectives before designing their sessions.

Insights from analysing the online conversations of HCPs in the US market were used by our client’s medical director to inform the planning of a successful advisory board, including:

- Selection of advisory board participants

- Attitudes to products, to inform discussion

- Relevant areas of unmet need, to explore in sessions

Since our client began by learning from the unprompted conversations of thousands of healthcare professionals, they were able to develop a picture of customer needs before designing their advisory board sessions.

The result was a highly focused advisory board in which the group of HCPs involved confirmed evidence and provided rich personal perspectives. The client team came away with clearly articulated insights on clinical practice, communication and digital media.

Evidence for regulatory and payer submissions

A pharmaceutical client planning for the future launch of a new drug gathered evidence from analysis of online HCP conversations to support its submissions for marketing authorisation and access.

Using CREATION Pinpoint, our online HCP insights service, we studied 39,000 HCP posts from 8,000 HCPs in five markets across a 12 month period. We developed unique HCP insights regarding the burden and impact of disease, identified Digital Opinion Leaders and analysed HCP digital behaviours in the therapy area.

Using our insights, the client was able to:

- Use evidence from online HCP conversations to ‘tell the story’ of the unmet burden of disease in market access negotiations.

- Align product positioning with HCP perception of key differentiators.

- Partner with influential HCP Digital Opinion Leaders concerned with the burden of disease.

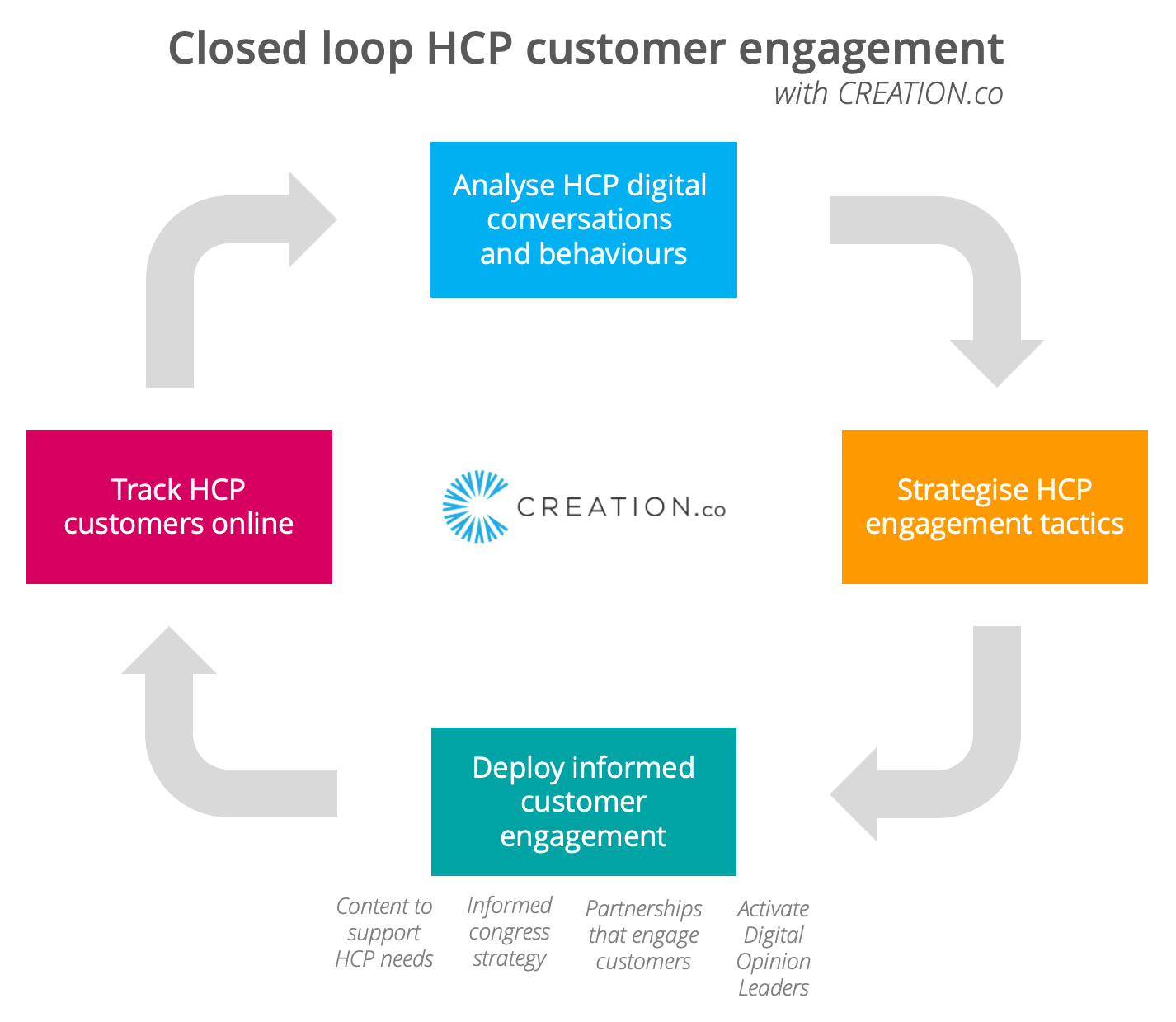

Closing the loop in HCP customer engagement

It is important to measure the impact of any changes in engagement tactics. By continuing to track the online conversation, and thereby closing the loop in your HCP customer engagement market research, you can continue to learn and innovate.

There are five steps in this process having identified a specific challenge or opportunity that you can only solve through a better understanding of your HCP customers:

- Track HCP customers online: Listen to the unprompted online HCP conversation and identify the digital behaviour of your customers.

- Analyse the HCP digital conversations and behaviours: Identify unmet customer needs and key opportunities on how to establish meaningful relationships with HCPs.

- Strategise HCP engagement tactics: Turn those insights into tactics to support HCP needs and create meaningful engagement.

- Deploy informed customer engagement: Apply those tactics in a variety of areas: relevant content, congress strategy, partnerships that engage customers and activate Digital Opinion Leaders.

- Close the loop: By continuously tracking how HCP customer conversation changes you are able to quickly identify emerging needs or possibilities as well as assess the how your previous tactics are resonating.

For more examples of this direct customer intelligence, you can find all our public research and resources on our website. If you have identified an opportunity where you need HCP insights or would like to discuss it further, then please get in touch.

This article was first published in 2020 and has been updated to include the latest ways pharma is using HCP social media market research.