For almost a year, CREATION.co has been tracking how healthcare professionals (HCPs) have been engaging with top 50 pharmaceutical companies on Twitter. In recent months, due to the global pandemic, the focus of this tracker has been shifted to investigate this engagement in relation to COVID-19, as it has impacted online conversation to such a large extent. In this review, looking back over the first six months of 2020, we will draw insights from changing behaviours to display learnings in this season when healthcare is primed for digital transformation.

Learnings from COVID-19

COVID-19 has been cited as a “wake-up call for pharma”, encouraging leaders to evaluate digital maturity and agility as traditional forms of HCP engagement such as rep visits with field force and educational meetings have been forced to adapt to the lockdowns happening globally. This season has presented an opportunity to focus personalisation of HCP customers’ experiences of company interactions, using digital communication alongside data driven insights to understand needs and wants of consumers. It has been said that when used correctly, digital strategies can keep reps connected with physicians more closely than ever. In fact research from ZS, indicates that when repurposing field force for “business unusual”, 34% of physicians say they’ll prefer engaging virtually with manufacturers in the “new normal” phase, with 90% of respondents agreeing with the hypothesis that virtual engagement will play a bigger role in a post COVID-19 world.

With all this in mind, CREATION Pinpoint, a unique technology tracking more than 2 million online HCP profiles, was utilised to distil the HCP voice discussing top 50 pharmaceutical companies on Twitter. Over 55,000 HCP authored posts were identified from 18,548 unique HCPs from January 1st to June 30th 2020, all mentioning or engaging with a top 50 pharmaceutical company.

The Top 50 Pharmaceutical companies mentioned by HCPs on Twitter

| Top 50 rank | Company Name | Total Mentions | Account mentions | Account retweets | Number of accounts mentioned |

|---|---|---|---|---|---|

| 1 | Gilead | 13,390 | 4,334 | 143 | 4 |

| 2 | Johnson & Johnson | 6265, | 3,853 | 1,242 | 23 |

| 3 | Roche | 5,392 | 2,064 | 186 | 8 |

| 4 | Abbott | 4,209 | 3,391 | 1,206 | 3 |

| 5 | GSK | 3,482 | 1,068 | 315 | 14 |

| 6 | Novartis | 3,224 | 1,208 | 285 | 14 |

| 7 | Sanofi | 2,914 | 1,178 | 204 | 18 |

| 8 | Pfizer | 2,895 | 1,454 | 216 | 13 |

| 9 | AstraZeneca | 2,306 | 1,305 | 83 | 7 |

| 10 | Bayer | 2,217 | 628 | 68 | 7 |

| 11 | Merck & co | 2,202 | 1,276 | 209 | 5 |

| 12 | Biogen | 1,384 | 190 | 42 | 2 |

| 13 | Lilly | 1,208 | 579 | 52 | 5 |

| 14 | Regeneron | 1,091 | 536 | 36 | 2 |

| 15 | Novo Nordisk | 973 | 832 | 164 | 8 |

| 16 | Teva | 595 | 133 | 38 | 6 |

| 17 | AbbVie | 581 | 266 | 29 | 3 |

| 18 | Takeda | 561 | 339 | 78 | 4 |

| 19 | BMS | 552 | 448 | 80 | 3 |

| 20 | Amgen | 507 | 335 | 71 | 3 |

| 21 | Boehringer | 466 | 368 | 118 | 6 |

| 22 | Mylan | 453 | 103 | 5 | 1 |

| 23 | Allergan | 321 | 89 | 0 | 1 |

| 24 | CSL | 300 | 138 | 60 | 2 |

| 25 | Fresenius | 287 | 166 | 29 | 4 |

| 26 | Vertex | 234 | 231 | 3 | 1 |

| 27 | Merck KGaA | 159 | 115 | 29 | 5 |

| 28 | Ipsen | 157 | 119 | 72 | 2 |

| 29 | Eisai | 157 | 6 | 2 | 1 |

| 30 | UCB | 153 | 25 | 15 | 2 |

| 31 | Astellas | 129 | 70 | 10 | 2 |

| 32 | Sun | 120 | 46 | 2 | 1 |

| 33 | Bausch | 110 | 21 | 1 | 1 |

| 34 | Celgene | 97 | 28 | 4 | 2 |

| 35 | Daiichi-Sankyo | 82 | 29 | 12 | 3 |

| 36 | Otsuka | 81 | 21 | 0 | 1 |

| 37 | Mallinckrodt | 62 | 22 | 16 | 1 |

| 38 | Alexion | 52 | 0 | 0 | 0 |

| 39 | Ferring | 46 | 29 | 6 | 1 |

| 40 | Chugai | 43 | 0 | 0 | 0 |

| 41 | Servier | 41 | 16 | 5 | 1 |

| 42 | Grifols | 34 | 0 | 0 | 0 |

| 43 | Menarini | 25 | 7 | 3 | 1 |

| 44 | Shire | 19 | 0 | 0 | 0 |

| 45 | Stada arzneimittel | 12 | 12 | 8 | 1 |

| 46 | Mitsubishi tanabe pharma | 6 | 0 | 0 | 0 |

| 47 | Sumitomo dainippon | 5 | 0 | 0 | 0 |

| 48 | Endo | 4 | 0 | 0 | 0 |

| 50 | Jiangsu hengrui | 0 | 0 | 0 | 0 |

| 50 | Sino | 0 | 0 | 0 | 0 |

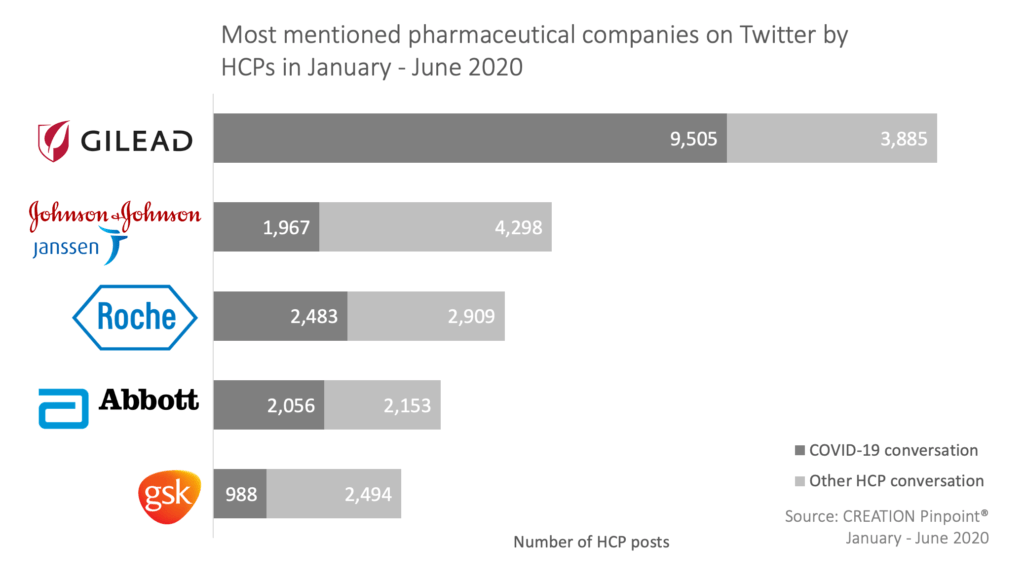

From January to June 2020, the five pharmaceutical companies that were mentioned the most by HCPs on Twitter were Gilead Sciences, Johnson and Johnson (J&J, includes Janssen subsidiary), Roche, Abbott and GlaxoSmithKline (GSK).

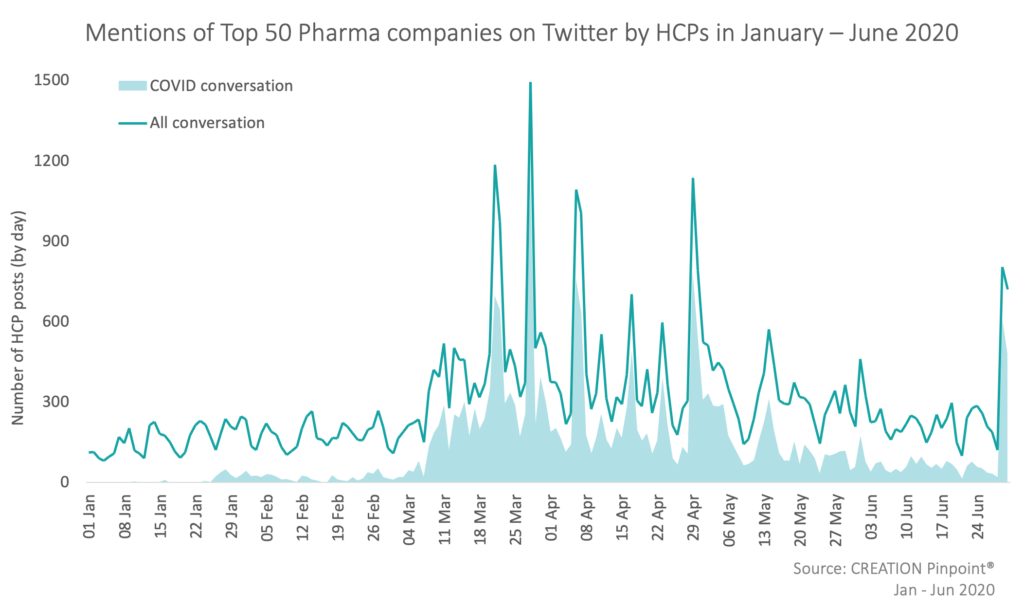

COVID-19 has had an incredible impact on HCP online engagement; of the HCP mentions of pharmaceutical companies on Twitter in the last 6 months, 40% is in the context of the coronavirus. Further, the average daily volume of conversation in January increased by 66% in June, following this there was a peak in the conversation in March when HCPs produced almost three times as many posts per day than in January.

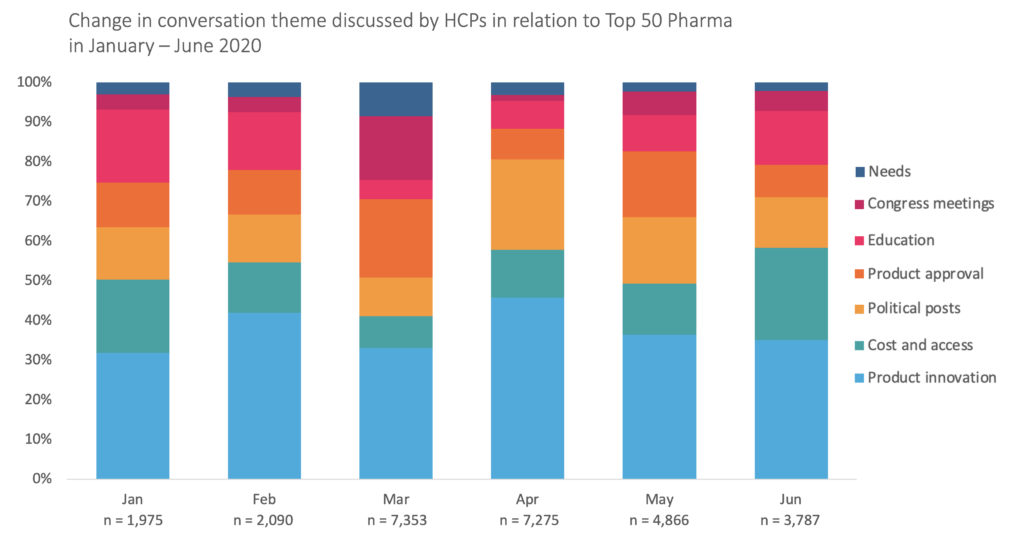

Understanding the breadth of the conversation discussed by HCPs online, how it changes and is affected by a variety of factors, allows an opportunity to learn how to enhance engagement strategies. Examples include producing content in a preferred format (eg infographics and videos), posting on channels where HCPs already are and at optimised times of the year, month or day. A finger on the pulse of changing reactions and drivers in conversation is the beginning of digital transformation; listening to the customer voice before making decisive plans. Even without segmenting conversation by company, brand or even therapy area, insights can be found revealing underlying motives within the existing conversation.

1. Education is a constant

HCPs continually post peer and public (non-HCP) facing educational content. Whether that be new product information or disease specific guidance, social media allows for a wide reach for appropriate and correct information to be shared. One way pharmaceutical companies can serve their HCP customers is to collaborate and provide such resources to be disseminated online. An example is this infographic produced by a migraine association in collaboration with Novartis in Ireland that was engaged with by both HCPs and non-HCPs, detailing guidance on managing migraines in women.

#IWD2020 #women and #migraine

A helpful infographic from @MigraineIreland and @NovartisIreland on managing migraine in women #MakeMigraineMatter #ChronicMigraine pic.twitter.com/K0YK4DOLX6— jane whelan (@janewhelan) March 8, 2020

As well as infographics, another form of educational material often shared by HCPs is podcasts. Among those shared, a successfully received podcast was the #SeeYouNow series produced by @JNJNursing with @ANANursingWorld highlighting innovative solutions to healthcare challenges driven by nurses. Whilst having a role specific focus, the podcast was shared by HCPs in various roles including emergency doctors and paediatricians.

So fun to #SeeYouNow :*)

Be sure to download/listen/share the COVID19 Nurse Response episodes at https://t.co/RXU472uRui and email me your stories!— Shawna Butler RN MBA 🇺🇦 💙 (@ShawnaButlerRN) April 17, 2020

Understanding the virtual format best received by HCPs is a key step to producing HCP friendly content. Beyond podcasts and infographics, videos and polls involving digital opinion leaders (DOLs) encourage peer engagement as HCPs develop their networks online. Such content often emerges from congress: the transition to virtual congress during the COVID-19 lockdown has offered a prime opportunity for companies to work alongside HCP partners in the digital space. Whilst educational content was shared less at the peak of the pandemic conversation in March, virtual congress continued to be a source of information sharing and progressive discussion online among HCP peers.

Whilst challenging congress norms (in the absence of in-person events) and encouraging new engagement strategies, some top pharmaceutical companies received positive mentions from HCPs during virtual congress in the first six months of the year. Digital behaviours changed as HCPs adapted to the online environment and pharmaceutical companies equally continue to have an opportunity to align with these new behaviours on social media.

@DrJNicholas

talking about treatment concepts in #MultipleSclerosis. Great talk!@MerckHealthcare Virtual Congress addressing different important issues about #MS therapy and #MSCOVID19 pic.twitter.com/KUWbHsmQrp— Dragana Obradovic (@DraganaObrado20) May 3, 2020

2. Product access is crucial to HCP care

Throughout the six months in question, HCPs have continually discussed the cost and access of products for patients. Since product innovation for COVID-19 was highest in April, the share of conversation on this theme has been increasing. In June, when the price of the highly anticipated COVID-19 treatment candidate, Gilead’s remdesivir, was announced HCP conversation spiked as they responded with apprehension. The posts with highest engagement and reach laid out multiple factors including the drug’s efficacy, sentiment towards “Big Pharma” and trial funding information.

Remdesivir price is out now. As I suspected, it’s not cheap

Gilead is charging hospitals between $3,120 and $5,720 per patient

Payment will begin in July, likely in anticipation of making a profit in the second wave of COVID-19

Lot of money for a drug w/ no mortality benefit. https://t.co/DsPvNc4NBx

— James Todaro, MD (@JamesTodaroMD) June 29, 2020

As HCPs consider their patient care above most other things, sometimes their own wellbeing, listening to HCPs as they raise these concerns provides an opportunity to build trust and harbour ongoing relationships with these HCPs. On occasion, HCPs will directly ask pharmaceutical companies for help on Twitter when they see issues around pricing or other product concerns. Social media gives HCPs a platform to discuss issues publicly with their peers during a season when field force and in person interaction among HCPs (and patients) is reduced. Some pharmaceutical companies have adapted and are more responsive, something requiring a strong agility, reassuring HCPs or directing them to information or help lines.

Should all cardiac devices now have remote monitoring? Surely best for patients. Many #NHS trusts find this too expensive and can only afford for some devices. Come on @MedtronicUK @BSC_RhythmUK @AbbottNews @Biotronik_UK surely you can help with pricing to help the #NHS?

— Dr Husain Shabeeh (@DrHusainShabeeh) May 6, 2020

Hi! Currently, we are not experiencing any supply constraints. We are well prepared for situations like this and have an inventory policy that serves long-term supply. Get more information here: https://t.co/Vc4gD93vEw

— Novo Nordisk Live (@NovoNordiskLive) March 30, 2020

3. Pharma always has an opportunity to support unmet HCP needs

Sharing unmet needs with pharmaceutical companies online has been consistent since the beginning of the year, but when conversation peaked in March, an increased share of the content discussed included such issues. Some pleas for help were shared by HCPs to increase reach: one post seeking access to remdesivir in March was shared by over 100 HCPs.

https://twitter.com/jigneshpatelMD/status/1242534350887030785

Product cost and access is not the only area where HCPs reveal unmet needs. Throughout product development as data was released and disseminated online, many HCPs posted about the need for additional studies, particularly randomised controlled trials (RCTs), to further establish efficacy. Responding to the FDA’s authorisation of Abbott’s coronavirus test, this doctor from the US laid out areas where more data and information were needed to establish the success of the test.

Agree! We need more details. Could be a breakthrough but… need much more data + info about rollout, availability of supplies, cost.

— Melanie Thompson (@drmt) March 28, 2020

Optimise and personalise the HCP customer experience

Listening to how HCPs have been seeking to engage top pharmaceutical companies in the first 6 months of this year has shown an opportunity to further optimise and personalise HCP customer experience. A large portion of the conversation is of HCPs sharing drug approval announcements, collaborations and data results. Observing how HCPs respond to these announcements, as well as conversations they have about products and related unmet needs means Pharma can learn and react more successfully.

It is key to consider that the present analysis has filtered HCP conversation to mentions of companies only; removing this filter and investigating entire therapy areas or geographic markets would multiply the insights offering a wealth of knowledge to understand.

Since the beginning of the pandemic, HCPs are looking even more to Pharma and sentiment is shifting to a more positive view. Pharma has reason to get involved in the digital space and provide above brand support. This can be initiated by developing capabilities to be meaningful engagers online, reflecting HCP conversations, not just communicating with a product focus. Just as a traditional field force should build strong relationships with customers, not only just selling, Pharma can learn from this to better support HCPs online. This is especially timely as rep visits are reduced due to COVID-19: digital is a new way to reach customers, who are already online, and build trusted and collaborative relationships.

Keep up to date with the views of HCPs mentioning Top 50 Pharma online, as well as other health related topics, by signing up to our monthly eJournal or by getting in touch.

Check out the latest of our monthly Top 50 Pharma Tracker and discover how HCPs discuss Pharma companies in the online conversation last month:

https://creation.co/knowledge/top-50-pharma-tracker/

Methodology

- Between Jan – Jun 2020, CREATION Pinpoint® identified more than 55,000 healthcare professional (HCP) authored tweets from over 18,000 individual HCPs mentioning a top-50 pharmaceutical company (according to revenue) on Twitter.

- Unless otherwise specified, mentions of a company are not limited to its Twitter account(s).

- In some cases, a tweet may mention more than one company account (eg. @abbottnews and @abbottglobal) – this only counts as one Company Mention but two Account Mentions.

- The Number of Accounts Mentioned only include those Twitter accounts mentioned by HCPs.

- * Johnson & Johnson was included as a whole, encompassing its pharmaceutical subsidiary, Janssen. In June, 22 of these posts mentioned Janssen.

- ** Whilst included in the Top 50 Pharma list according to revenue from 2019, Shire has since been acquired by Takeda and no longer holds a Twitter account.

By Mary Kangley

By Mary Kangley